You will also need to consider whether the indicator contains only core elements of technical analysis, such as pattern recognition and mathematical calculations, or if it combines elements from existing indicators, such as moving averages and the RSI indicator. Register for an MT4 account to get started.įirstly: you must choose what type of indicator you would like to build: leading or lagging. In order to start building a custom MT4 indicator, you should be familiar with MQL4 and MetaEditor tools. If traders cannot customise existing technical indicators to their preferences, they often prefer to create an MT4 indicator online. It can be used with the majority of forex technical indicators.

#ADVANCED GET INDICATOR MT4 WINDOWS#

This tool allows you to see the same standard indicators on the platform in separate windows across multiple timeframes.

MT4 indicators using multiple timeframes are very useful for both long-term and short-term traders. However, in reference to day trading above, you may lose out an initial period of profit by entering late to a trade.

#ADVANCED GET INDICATOR MT4 FULL#

Lagging indicators only prompt the trader to open a position with full certainty of the market trend, which is a benefit over leading indicators. However, it is not possible to have full consistency in pattern recognition, and can often mislead the trader into entering a market with unrealistic expectations.

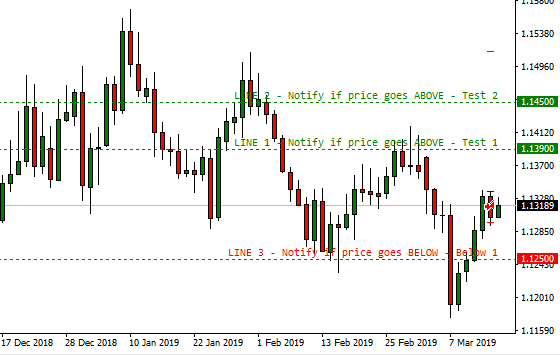

For example, when accurately predicted, leading indicators can ensure profits for the trader. There are benefits and downsides to both of these types of MT4 indicators. On the other hand, a lagging indicator informs the trader of the new trend while it is happening in that moment. When analysing a price chart for market trends, a leading indicator will inform traders before the new trend or reversal happens. There are two main types of technical indicators used for trading in MT4, which are known as leading and lagging indicators. This is because day trading strategies aim to take advantage of small price movements by closing out the position before the end of the day. Time is also a very important factor in choosing the right indicator, as profits and losses can exceed one another within a matter of seconds in a short-term trade, such as day trading. In particular, traders aim to identify support and resistance levels to see how an asset is fluctuating in price. Technical indicators demonstrate trend lines on a price chart.

0 kommentar(er)

0 kommentar(er)